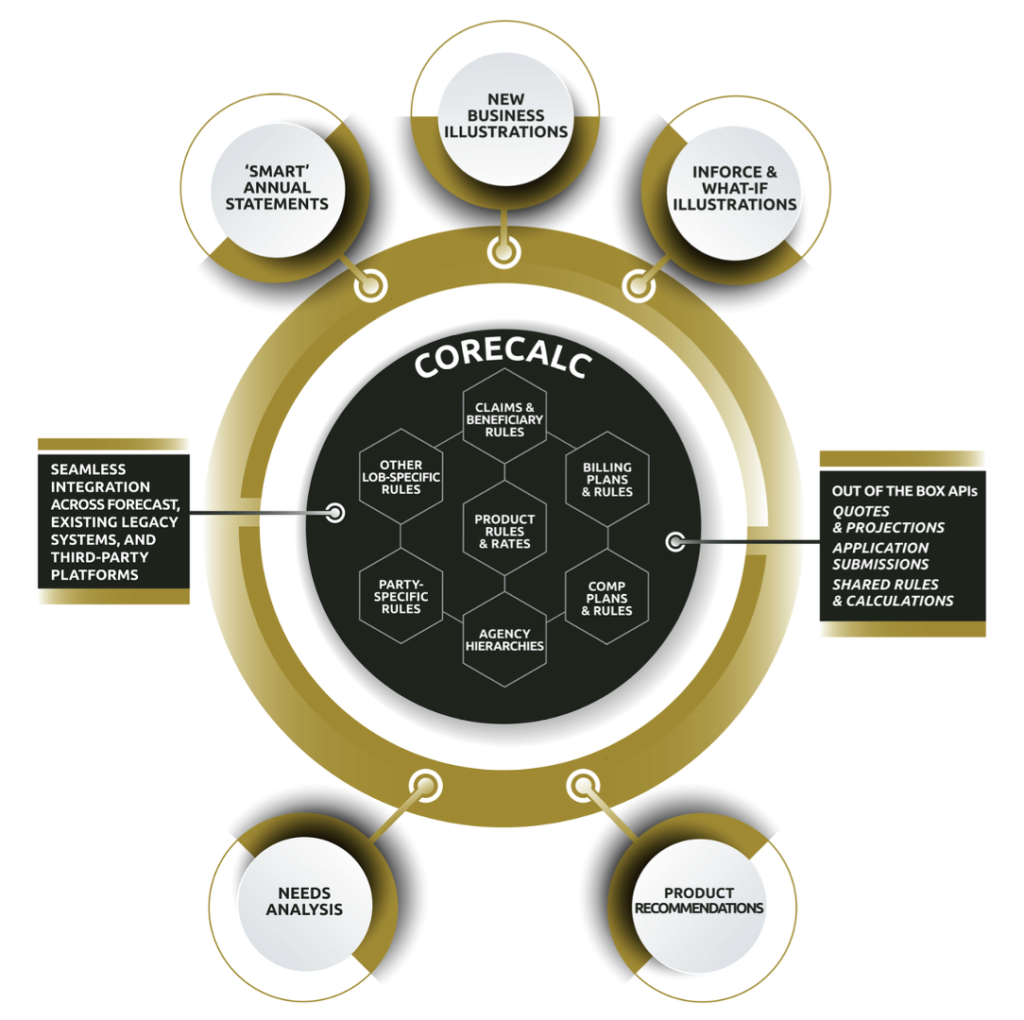

Enhance your product presentation with Forecast, our best-in-class illustration platform staff, advisors, and clients will love. Fast. Accurate. Intuitive.

Provide advisors advanced “what-if” visualization while reducing manual work by defaulting to most frequent scenarios. Create smarter annual statements to keep policies in-force. Engineered by insurance experts, Forecast easily plugs in to your policy admin platform and advisor portal.

Needs analysis

We offer stochastic modeling Illustrations that include life insurance needs and retirement liquidation optimizers plus inforce illustrations to keep selected life and annuity products “on-track.”

- Product recommendation engine based on client needs

- Optimize financial capital accumulation based on risk-sensitive asset Allocation

- Human capital determination

- Optimize life insurance determination

- Optimize retirement liquidation allocation

Best-in-class illustration functionality

Our extensive what-if capabilities allow you to fine-tune and customize product recommendations based on client needs. Here are some key features and use cases you will find with Forecast:

- Extensive what-if capabilities allow you to store predefined scenarios to address most frequent service request / questions.

- Portfolio of web-services that enabled integration with policy admin platform and/or employee portals (i.e. policy health check, correspondence integration, policy projection values, etc.).

- Intuitive graphical representation of projected values available to agents, service reps and customers

- ‘Smart’ Annual Statement

- Provides carrier clients with options to keep policy on track

- Detect future lapses and provide “solved for” remediation options (e.g. Face Decrease, Premium Increase)

- Detect scenarios where guideline limits prevent policyholder from paying premium, yet policy will lapse. Present reports and graphs to visualize the scenario.

- Provides carrier clients with options to keep policy on track

WANNA LEARN MORE?